In just over 20 years in business, Team Financial Group has helped companies just like yours secure a total $600 million in financing. We pride ourselves on being easy to work with, efficient, and fully committed to helping our clients achieve lasting success. That’s why you need a financing partner who understands your business and can offer fast, flexible, and affordable options to help get your company from point A to point B. Sign up for the 365 Financial Analyst platform and advance your finance career. If you already have an account, log in and pick up where you left off. This function marks the entire row of values below the cell you initially selected.

- The rate of return can be calculated for any investment, dealing with any kind of asset.

- The calculations provided should not be construed as financial, legal or tax advice.

- The initial amount received (or payment), the amount of subsequent receipts (or payments), and any final receipt (or payment), all play a factor in determining the return.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- The sequence of returns risk (SORR) is when, despite yielding adequate average returns during retirement, a portfolio will run out of money if it generates below-average returns early in retirement.

- Positive rate of return calculations indicate a net gain on your investment, while negative results will indicate a loss.

Part 2: Your Current Nest Egg

For this reason, SORR is often the largest risk to retirement spending. Not only did the portfolio survive 96% of the time, but it had a 90% chance of leaving more than 100% of the starting balance. Said another way, a retiree using the 4% rule finished with less than their original portfolio size just 10% of the time.

What Is Considered a Good Return on Investment?

Benchmark comparisons give meaning to your rate of return and help you evaluate whether you’re outperforming on a relative basis. For example, the S&P 500 might not serve as a fair benchmark for a portfolio invested 100% in international equities, as these are substantially different investment types. It’s useful when compared against a benchmark index, return expectations, or other investment options to gauge how your investment performed on a relative basis. Excel is a powerful purpose-built application designed to crunch numbers and is a go-to-standard when making investment calculations. In research that looked at the most important factors when it comes to portfolio longevity, it was found that the first 10 years of retirement matter the most.

Return on Investment (ROI) Calculator

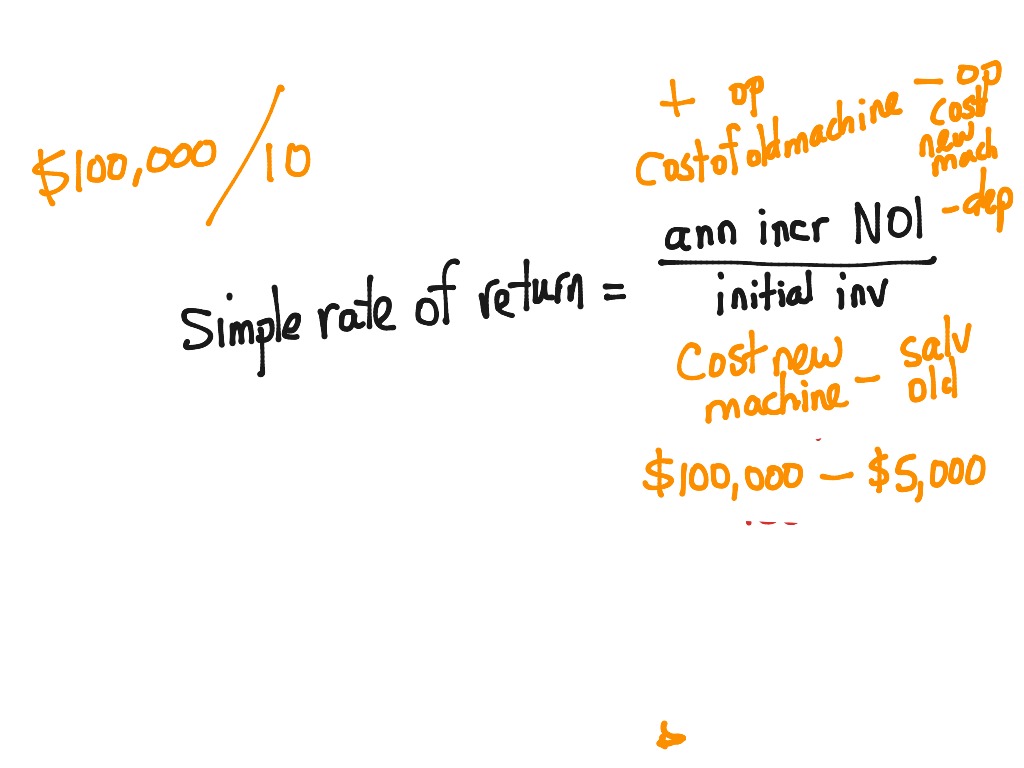

You can calculate the rate of return on your investment by comparing the difference between its current value and its initial value, and then dividing the result by its initial value. So, if the first 10 years of retirement go well, meaning the market generates average or better returns and/or you start with a low withdrawal rate of 3–4%, you’ll likely have plenty of money left after you die. The simple rate of return formula assumes that the amount of the increase in annual revenues and expenses will be constant, but in practice this is usually not the case. It may take you a few years before you’re able to reach your new capacity with new clients or orders. Many times, ROI cannot be directly measured, such as the investment of advertising a product. The ROI in such situations is normally estimated via the marginal sales benefit or brand recognition.

Other Rates and Measures

And since failure means running out of money in retirement, most investors choose a conservative SWR that’s toward the bottom end of this range — e.g., 3.5%. Add these two figures together, and you get annual incremental expenses of $33,000 per year. Then select historical data and download the stock prices from July 1, 2018, to July 1, 2020. In other words, we aim to find the total return of an investment, not just the change between the ending and beginning value. Joe wants to now calculate returns after the 10th year and wants to assess his investment. For additional practice look at this exercise on the simple rate of return method.

What Are Some Drawbacks of RoR?

By comparing the expected or historical rates of return, investors can make informed choices about where to allocate their capital. Holding period return (HPR) captures both the change in your investment’s value over time and any periodic benefits you receive from it. It is expressed as a percentage, rather than an absolute dollar amount.

The rate of return formula is used in investment, real estate, bonds, stocks, and much more. The rate of return is the asset that has been purchased and got in income in the same year or future. The formula of the rate of return is used in that asset when sold for a certain amount of money and determining the percentage gained from it. Due to its limitations, arithmetic mean return is not commonly used to evaluating long-term investment performance or compare investments over different time frames. It is more suitable for calculating average returns over shorter periods or when the compounding effect is insignificant. This rate of return includes capital gains and generated income, such as dividends or interest.

The precise answer is 12.379%, which appears if you set the initial investment to $1,000 with a final amount of $5,000, 10 years investment length, and $100 periodic deposit. Don’t be fooled into thinking you need to stick with the same withdrawal rate for 30 years. You can adjust your spending to your income during your retirement years, just like you did in your working years. Despite an average return of 8% per year and withdrawing 8%, the portfolio has fallen by -36.04% in the first five years of retirement, a completely unsustainable path. Furthermore, the portfolio finished the 30-year time horizon with more than double the starting principle nearly 70% of the time. The median wealth at the end — after taking 4% withdrawals adjusted for inflation — was almost 2.8x the starting balance.

This is why ROI does its job well as a base for evaluating investments, but it is essential to supplement it further with other, more accurate measures. Return on investment is a very popular measure because of its simplicity and usefulness. Now that you know how to calculate ROI, it’s high time you found other applications which will help you make the right choices when cash flows from financing activities investing your money. We are sure that the ROI equation is not the only thing you should be familiar with to make smart financial decisions. Return on investment is a useful measure to estimate the surplus of net investment benefit on an accrual basis. As a simple method, ROI is used primarily as an auxiliary at the initial stage of assessment of the investment project.